- HubPages»

- Education and Science»

- History & Archaeology»

- History of the Americas

After the Peak: Understanding Latin America's Recently Stalled Economy

From around 2002 to 2006-7, Latin America experienced one of the strongest economic performances it had seen in many decades. After two difficult consecutive decades (the 1980s and 1990s) the region appeared to have made strong gains in economic growth that in many countries resulted in positive results in the reduction of poverty, income inequality, and in most cases, macroeconomic stability. The region now approaches socio-economic problems with new development strategies that could potentially limit the external shocks of international markets. Perhaps the most important and transcending reason for these positive gains resulted from the improvement in the terms of trade (the ratio of the price of its exports to that of its imports) for Latin America due to a boom in international commodity prices and natural resources; one that was reinforced by the opening decade of the 21st century with the high demand for primary products from Asia, particularly its power star, China. But as the commodity boom draws to a close in more recent years, and different development strategies from different countries tackle this reoccurring problem once again, it begs the question whether the region really did learn anything from its past mistakes, whether a new form of dependence from China and other booming nations is in the making, and finally, whether Latin America can once again survive beyond the fluctuations of the international market.

In order to best understand how Latin America reemerged itself into the global economy after years macroeconomic instability and deepening social problems, one must first take a look back into the not too distant past of the region, and understand the similarities and differences in the performance of various countries in the region, that at one point of the past century, also experienced a heterogeneity of populisms with the import-substitution-industrialization strategy for development, and consequent economic bubbles being inflated and then burst. This will also help us understand and dissect the patterns in the region that have repeated themselves currently after similar instances that occurred in the past brought about not only some of the worst aspects of demagogic populism, but also some of the worst inefficiencies that comes from either having a flawed market economy, or in some cases, being unable to escape from the negative externalities of market rules, even at times when escaping the dependency patterns has been the aim. In other words, it is almost impossible to separate the political aspect of this reoccurring problem, as it is at times a matter of political will and technocratic arrangements what tend to be variables in the economic equation of a thriving economy in an increasingly globalized market.

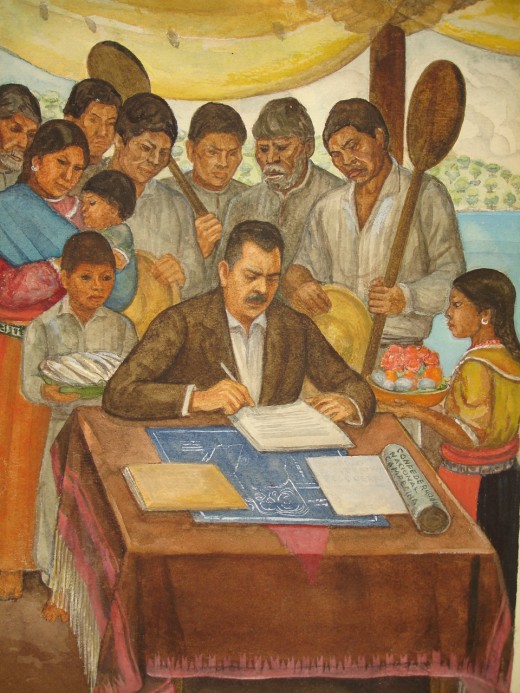

President Lazaro Cardenas (PRI) nationalized Mexico's oil industry in 1938

President Carlos Andres Perez of Venezuela nationalized the oil industry in 1975

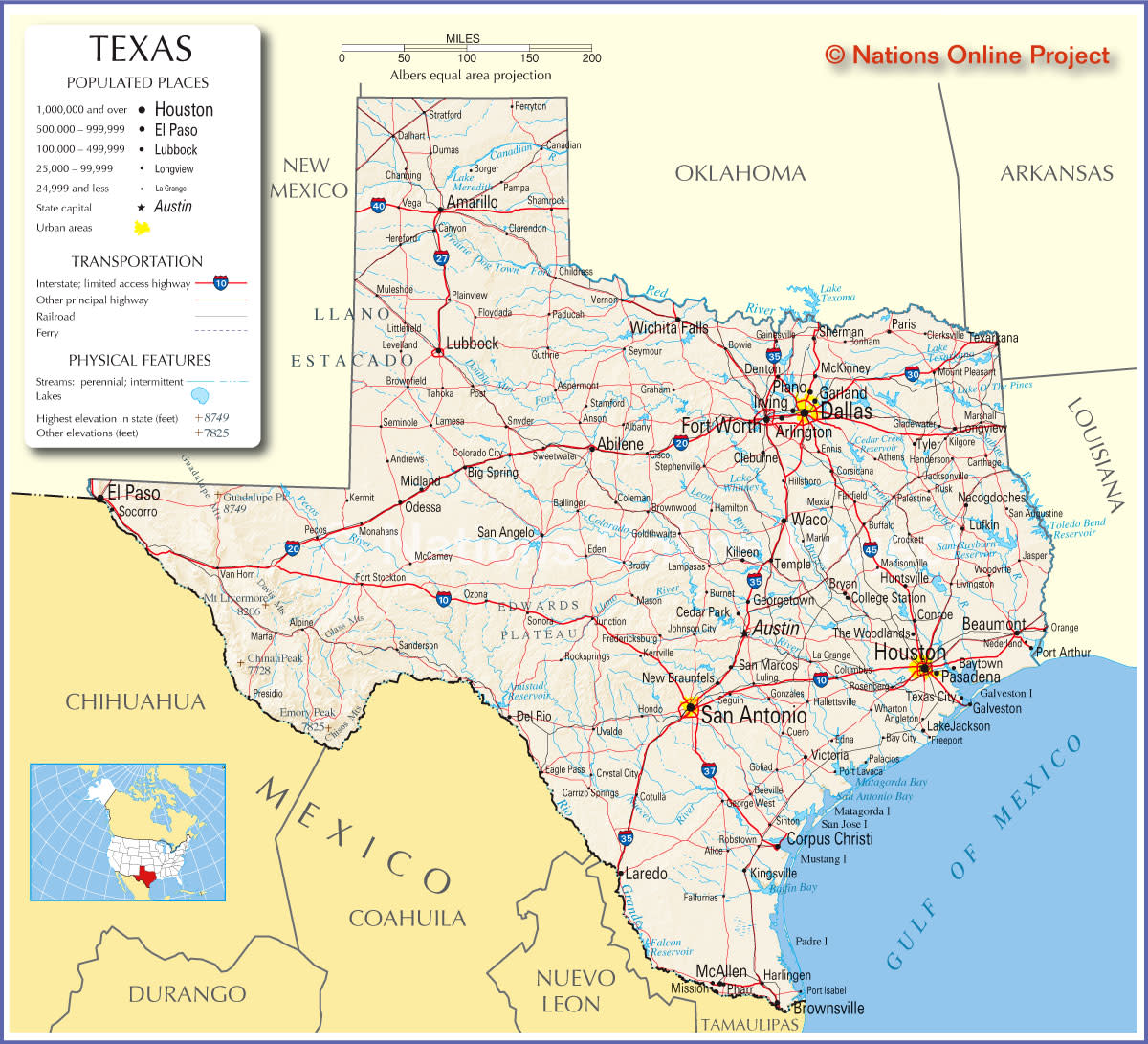

The beginning of this economic trait across developing nations, and in particular those in Latin America, in many ways may have begun with the decades that sought to balance out the negative terms of trade with more developed market economies such as the ones seen in the US and Western Europe, by channeling the strategy of Import-Substitution-Industrialization (ISI) promoted by the works and findings of Argentine economist Raul Prebisch, Hans Singer, and other prominent Dependency theory economists of the 20th century. This strategy sought to end the trade patterns of dependency of global southern peripheral countries from the more wealthy economies for production, capital flows, and trade disparities by investing heavily on domestic production to replace foreign imports. This strategy, also known as "Latin American Structuralism" became the norm of many Latin American economies from the 1950s to about the late 1970s, from the seven-decade long regime of the PRI in Mexico, passing by the regime of General Juan Peron in Argentina, to the "Punto-Fijo" period of liberal electoral democracy in Venezuela. In all of these cases and also for the rest of most Latin American economies during this period, the growth and transformation of the state as a major player and investor in the economy became thus essential. As Leonardo Vera points out, "the transformation comes in spurs and it is not a balanced process of structural change, technical progress, and capital accumulation that brings about disproportionalities, sectoral disequilibriums, bottlenecks, social and economic conflicts, and indivisibilities." (Vera, 918) This must be understood as a period that experienced "a change in the overall makeup of an economy in terms of the composition of output and resources among firms, industries, and regions; in consumption patterns; in the composition of imports and investment demands; in the distribution of income; and in the insertion of firms, industries, or regions into the international system." (Vera, 918) This transformation into an economy where the state served as the chief investor in industry created the socio-economic conditions (that in many ways still persist today in the region) that enabled the clientelistic relations of industry and the general populace with the state. This meant that access to finance for production of industry became subject of "export concentration, high external debts, volatile exchange rates, high interest rates, and inflationary cycles" (Gaillard, Hira, 163), prompting the need for large scale external borrowing in order to finance short-term projects. In many instances, this was achieved through the nationalization of key industries such as the oil sectors in the cases of Venezuela and Mexico, and the copper industry in Chile, alongside a strategy that focused on increasing internal domestic production as a counter to foreign direct investment.

Caracas, Venezuela

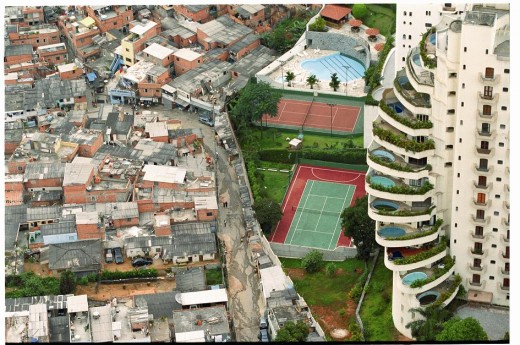

São Paulo, Brazil

As industry deepened its client-based relationship with the state, so did access to state-sponsored welfare programs, which were often financed through the revenues of state-owned industries. In many countries ranging from Brazil, to Colombia, Mexico and Venezuela, a large-scale rural-to-urban migration of millions of people looking for jobs in heavily-vested industries inside the cosmopolitan cities in the region occurred, a phenomenon that created a 'dual economy', where the jobs created by industry lacked a competent and highly skilled trained workforce able to perform the duties needed to expand and export capital. The result was that millions of people were increasingly left in poverty as there were not enough high-paying jobs available to satisfy the immediate needs of the newly installed working sectors of societies that had increasingly migrated into the big cities. This surprised many economists that promoted structuralism, as it quickly became a phenomenon that many did not foresee. The unemployed, low-skilled masses went on to become, as briefly mentioned previously, an underemployed 'dual economy', also known commonly as the "informal" sector of the economy, which due to the lack of access to finance and resources for expansion, settled across hilltops surrounding the cities, many in cheap brick-built houses that went on to become slums known as "barrios" or "favelas". The expansion of these slums in the cities soon prompted the need for many states to expand the expenditures of welfare programs that opened up a cycle of increased inflation and macroeconomic imbalances in the overall economy that largely further impoverished the masses, making the increased state social spending limited in its goal of addressing the issue of large-scale poverty. The creation of these slums are widely regarded by many to be one of the many longstanding legacies of the ISI model of development that persisted in the region during this period, and the socio-economic inequalities it created, as these vast slums are still seen today in cities from Medellin, to Rio de Janeiro, Caracas, Lima and La Paz.

During the peak points (the 1960s and 1970s) of the structuralist period in Latin America, the region experienced an annual growth of 6.0 percent; a peak that as explained, not only prompted the massive ability of states to spend in order to develop a stronger domestic industrial sector, but this also meant that states with big budget deficits were compelled to look for accessible methods of finance to keep up with the demands of their growing populations. Philip Swan explains how this financing was made available by acknowledging that "the deregulation and liberalization of world financial markets and the OPEC price shocks in the 1970s resulted in a rapid expansion of bank lending to Latin America. At the same time, export revenues soared. As long as real interest rates on the debt remained below the growth of real exports, the debt-export ratios were manageable and the borrowing could continue." (Swan, 19) This model of development began to come to an abrupt end beginning in the late 1970s, when the export-based model of growth and development, paired with the low interest rates of that period came to a foreseeable end. This meant that funds could no longer be accessed to finance the ever growing debts without first increasing the debt-export ratios. Consequently, credit worsened for the region, yet countries continued to largely borrow from international lending institutions as debt financing was achieved through exploitation of domestic resources that many states had relied upon for growth, production and development in order to facilitate short-term domestic consumption, and not long-term investments in industry.

Mexico's 1980s Debt Crisis

The booming years when inflation could be relatively controlled by access to credit and finance, had finally put a halt to the populist tendencies of many countries that had assumed high commodity prices would stay up while interest rates would stay low. Thus began a new period of neoliberal reforms in the region that buried structuralism's ISI strategy for development, and brought about very difficult years to a region accustomed to a pattern of improved terms of trade with the developed world. Macroeconomic stability very rapidly became the main priority for governments across the region, many of which were as quick to endorse and massively implement liberalized reforms as they once were at a previous time willing to endorse populism. By the 1980s, as commodity prices collapsed, the once 6.0 percent annual growth and low inflation that had benefited the region turned into a 1.0 percent growth and an annual inflation of 300 percent. Among the prescribed neoliberal solutions to the inflationary and debt crisis across Latin America included large-scale privatization of public enterprises and pensions, an enforcement of property rights, deregulation of banking systems in order to permit "central banks to make tough monetary decisions in setting realistic market-based interest rates, thus cutting inflationary cycles, spurring liquidity and efficiency in investment, with the effect of improving exports" (Gaillard, Hira, 164), decreasing social spending, cutting tariffs, and ending the patronage-based relationship of the state with industry by largely encouraging foreign direct investment and free trade.

'El Caracazo' in 1989 was Venezuela's biggest social explosion in its history. Thousands were left dead.

In terms of debt service, inflation, foreign direct investment, and budgetary surpluses, with the exceptions of Argentina and Venezuela, the overall Latin American region yielded positive results, which led to lower costs of borrowing for most countries. On the other hand, most countries also experienced the externalities of neoliberalism as an economic doctrine inconsistent with the immediate social necessities of a widening impoverished population laced with income inequality, pushing a widespread cynicism and rejection towards establishment liberal and conservative parties that were so characteristic of 20th century Latin America.

"Fernando Cardoso, the famous and influential sociologist once critical of structuralist and neoliberal processes, governed two terms as president of Brazil"

With the turn of the century dawning in the region, a new chapter in the political history of Latin America gave rise to a new wave of populisms that once again, may have benefitted more from external international market forces than internal politics, as it once did at the dawn of the structuralist period for populist regimes that governed from the 1950s to the late 1970s. This new wave of populism, characterized in many countries by the emergence of left-leaning parties and politicians across Latin America was neither homogenous in nature, nor new in its vertical-shaped power relation with different sectors of society. Some would even suggest that this reopens yet another cycle of reoccurring political processes were the masses grow dissatisfied with traditional ruling elites and evolve into newer forms of political participation throughout society. Even in Brazil, were Fernando Cardoso, the famous and influential sociologist once critical of structuralist and neoliberal processes, who governed two terms as president of Brazil in the 1990s with market-oriented policies that yielded very positive macroeconomic results, suffered the fate of his centrist Brazilian Social Democracy Party to be succeeded in 2002 with the more progressive Workers' Party. This pattern (with variations to be considered) are most predominant in countries that struggled (or failed) to adjust to the neoliberal reforms of the previous two decades, as it was the case for Argentina, Ecuador, and Venezuela.

In 1992, Chavez and other military generals pursued a failed attempt at violently overthrowing the elected government of Carlos Andres Perez

Perhaps the catalyst for some of these leftist movements in the region may have begun in Venezuela with the ascend of military general Hugo Chavez to the presidency in 1999, after having failed to violently overthrow the democratically elected government of Carlos Andres Perez, who at the time in 1992 was attempting to implement neoliberal reforms to the ongoing economic and debt crisis that had perished the oil-rich nation for more than a decade of collapsed oil prices. While initially not subscribing to the socialist ideology, Chavez was very successfully able to channel the national discontent with the ruling liberal and conservative establishment parties that had to endure attempts at implementing neoliberal reforms to reverse many populist policies that initially had propelled them to power (and extreme popularity like in the case of Carlos Andres Perez’ first administration) in the booming decades of the high oil prices of the 1970s. The process in Venezuela of implementing neoliberal policies had not achieved entirely its projected results (unlike it did for countries like Chile and Brazil), as a series of ongoing administrations prior to Chavez often continued to switch back-and-forth between neoliberal policies and attempts (though failed) to lessen the socio-economic repercussions of such applied reforms by lightly applying small doses of populism that did not seem to satisfy nor the social needs of a growingly poor population nor the economic necessities of an indebted country enduring high levels of inflation, thus at times exacerbating the problem. Even Chavez himself met this reality in his initial years as president when his popularity seemed to be tied to the low international oil prices (literature suggests the same could be argued for many presidents presiding over oil-rich nations), by having to tackle national discontent over being unable to tackle the prolonged economic crisis, including having to endure a US-backed attempt at briefly disposing him from power. But as commodity prices skyrocketed beginning in 2002, and with the US invasion of Iraq in 2003 pushing international oil prices to unprecedented record-high levels, it seemed that a once vulnerable Chavez suddenly had the opportunity and chance to experiment with a new strategy for development.

Latin America's Political Map as of 2010

Similar processes of leftist political forces being interrelated to high commodity prices in the region took places during this period ranging from Argentina’s soybean boom giving rise in 2003 to Nestor Kirchner (and consequentially his wife Cristina Kirchner) who were often compared as the symbolic heirs to the legacies of General Juan and Eva Peron, to Chile’s copper boom giving rise to the first democratically elected president of Chile’s Socialist Party since Salvador Allende, Ricardo Lagos, who was then succeeded by Michelle Bachelet (also from the ruling Socialist Party), who left office with an unprecedented level of nearly 80% popularity in 2010. This pattern could also be seen in the past decade in Bolivia, Brazil, Ecuador, El Salvador, Honduras, Paraguay, and Uruguay. Authors Luisa Blanco and Robin Grier explain this phenomenon by suggesting that “voters may reject conservative politicians who campaigned on business-as-usual platforms, especially if government coffers were newly flush. Left-wing politicians can credibly promise more rents from these commodities than right-wing politicians. They can (and do) promise to nationalize companies (Chavez), demand higher royalty rights (Evo Morales) by renegotiating with foreign companies, or raise export taxes (the Kirchners). Minerals and oil are often directly controlled by the state, which allows the government to redistribute resource rents. Even when the commodity is not in state hands, however, the government certainly taxes those sectors, and we might again expect left-wing candidates to be more successful during commodity booms.” (Blanco, Grier, 76) However, Blanco and Grier do make the distinction that voters may not necessarily “be against conservative policies per se, but they may instead be reacting to poor economic conditions of the 1980s and 1990s.”(Blanco, Grier, 70) An example that stands out in the region is Colombia’s former president, Alvaro Uribe who governed two consecutive periods with high popularity (also partly due to the same beneficial economic environment as in countries with more progressive executives) from 2002 to 2010 with very conservative social and economic policies, although in this particular case, other factors must be taken into consideration when explaining Uribe’s popularity, such as his effective crackdown against the FARC and ELN guerrillas, that while controversial, earned him positive approvals from a country torn by many decades of a bloody civil war that was finally able to enjoy relatively lower levels of overall violence. Blanco and Grier do warn, however, that if “the resurgence of the left is mostly due to a boom in commodity exports, then the staying power of those parties may be compromised. It is well known that commodity export prices are, on average, more volatile than manufactured exports. If governments are relying heavily on gains from commodity exports to ramp up social spending, then they may find themselves in trouble when commodity prices fall again” (Blanco, Grier, 73), and this will precisely be explored more into depth, as we explain later on where countries like Argentina and Venezuela stand today economically, and how the policies pursued during the most recent commodity boom years are now affecting the economies of countries that did not diversify their economies nor achieved macroeconomic stability during the boom years.

Global Commodity Prices Throughout the Years

Just like in the boom years of the structuralist era of the 20th century, Latin America saw itself in the first decade of the 21st century with a favorable global economic environment. For example, “overall, the export prices of Latin American products have more than doubled since 2002. The prices of the leading export commodities of Latin American economies such as crude petroleum and petroleum products, copper, soybeans, coffee, and oil seed, which represented a quarter of total exports of goods in 2005, increased by 143 percent, 123 percent, 26 percent, 104 percent, and 40 percent, respectively, between 2002 and 2006.” (Pérez Caldentey, Vernengo, 631) This could potentially repair some of the damage caused not only by the cold-medicine approach to macroeconomic stability pursued during the neoliberal reformist period, but also some of the structural grievances brought upon by the irresponsibility of populist regimes of the ISI era. “Long-term international interest rates were low; commodities were solid, including strong Chinese demand; and Venezuela had become an active lender in the region.” (Gaillard, Hira, 175) Though, as we’ll soon exemplify, not all lessons of the past were learned, nor have all new development strategies adopted by the emergence of new populist movements, created socio-economic conditions that will yield long-term positive results (other than short-term political gain) that might prevent difficult years to come when international market forces based on consumption, supply and demand evolve into different economic periods.

Because of the particularity that not all countries in Latin America approached this renewed period of prosperity in the same manner (even among those with left-of-center executives and ruling parties), it is here that we explore the different (and current) approaches to development that can be seen in the region; from the Neoliberal approach seen in more conservative economies such as Colombia, Mexico, Peru, among others, to the Neo-Structural (or Neo-Keynesian) seen in Brazil, Chile, Uruguay and others, and finally the Bolivarian social reform approach prevalent in Venezuela, Bolivia, Ecuador, and to a lesser degree Argentina (which could be seen as a hybrid between a Neo-Structural and Bolivarian approach). It is also important to point out that in all of the cases that we are about to explore, all of the economies in Latin America, including those self-proclaimed as “socialist” are in one way or another, inherent market economies that have merely been reformed within the rules and logic of a market environment, thus they are susceptibly exposed and vulnerable to changes in international markets, exchange and interest rates, and the prevalence of the private sectors as the dominant engine for its share of the economy in all of the countries in the region with electoral democracies.

The second generation of Neoliberal reforms applied by more conservative economies in the region have among its distinctions, the signing of free trade agreements with the United States, Europe, and even Russia and China in some cases, and the prioritization of doing away with structural impediments for efficient markets such as “lack of clear property rights rules, due to weak judicial systems to enforce contracts, and unreliable institutions and regulation agencies, such as political pork barrel runaway spending by governments” (Gaillard, Hira, 175), though in many regards, all of the countries consistent with this strategy continue to persist structural and institutional problems that partially diminishes the long-term health of their economies and social sectors. In many of these scenarios, the state serves as a mediator pushing for transfer of capital in the form of privatizations with a strong financial support by the state as the backbone of its implementation.

Peru's Poverty headcount ratio at national poverty line (% of population)

One of the often perceived notions about this approach is the argument that it often worsens the social conditions for the most vulnerable popular sectors of society, and while in regards to income redistribution, the financing of social programs, and other variables show significant evidence to prove so (particularly in the case of Mexico), the past booming decade has shown however, even in these countries, significant improvements in the overall reduction of poverty. The same indicators from the World Bank that emphasize the sharpest poverty reduction rates in the region over the past decade being Brazil and Venezuela, also point out that Colombia reduced its percentage of its population living in poverty from 47.4% in 2004 to 32.7% in 2012, while Peru went from 58.7% poverty in 2004, to 25.8% in 2012. Just like in the case of other countries with different development strategies, the gradual reduction of poverty in these countries have to do with the available increased revenue for the state that stem from high commodity prices, though the manner and extent to which these countries balance their finances and state spending vary across the different new development strategies.

Inside Brazil's Economic Boom

The next reform strategy for development is most commonly referred as the Neo Keynesian strategy (though it often is regarded as Neo-Structuralist at times), and so far, seems to be not only the most prevalent and influential in the region, but also the only one that has been hailed across the ideological spectrum as the most effective of the three, partially because of the enormity of its potential to expand political and economic capital; largely due to the ability of its biggest proponent, Brazil, to attract foreign investment, and expand its share of trade across the region. Though not as flamboyant or controversial as the personalistic polar extremes of Chavez and Uribe in the region, perhaps the most relevant and influential political figure in Latin America over the past booming decade, resides in Brazil’s former head of state, the charismatic Luis Inacio ‘Lula’ Da Silva, a self-described ‘socialist’ who governed South America’s giant economy from 2002 to 2010, and provided the political and economic framework for the region that called for increased markets, the payment of external debts to financial institutions, a strengthening appreciation of the monetary exchange rate, minimum wage increases, and the use of the revenue generated by increased exports to fund social programs and cash transfers to the poorest sectors of society. This proved beneficial to the overall good health of the Brazilian economy, which very rapidly evolved into mutually beneficial factors for the remaining economies of the region, as Norbert Gaillard and Anil Hira describe, “the decreasing public debt, improved debt management and international competitiveness and the strong credibility of Lula may have contributed to the economic stability of the region, particularly the Mercosur countries tied to Brazil. (Gaillard, Hira, 169-170).

"Neoliberalism with a happy face" - Proponents of Neo-Keynesianism/Neo-Structuralism

Another way to regard this strategy seen in countries like Brazil and Chile could be seen as “‘tinkering’ with neoliberalism, giving it a ‘human face’.” (Gaillard, Hira, 175) Proponents of this strategy for development share the neoliberal notion that growth promoted unilaterally by the state, as it was predominantly the case in the previous century when ISI structuralism prevailed as the leading economic doctrine, can prove largely inefficient and troubling for the long-term stability of the economy. However, Neo-Keynesians also dispute the long term benefits of a fully liberalized and deregulated market, not just on the risks and pressures it puts on workers, but also on its failures to address the externalities that an overly liberalized financial sector may have on production being stalled, leading to capital flight, or as Chilean economist Ricardo Ffrench-Davis referred to it, “the ‘short-termist’ nature of capital and financial flows in the context of the 1990s, leading to ‘naïve financial liberalisation’, rather than long-term productive investments.” (Gaillard, Hira, 176) Ultimately, like all the described methods, this strategy for development does contain its certain share of flaws, as it is a form of development prevalent in countries with weak banking sectors, inefficient income distribution systems, corruption (predominantly in the case of Brazil), and it shares two common features that are very much representative of the rest of the Latin American region, regardless of their strategy for development: one is its volatility towards international markets and its prices set for commodities, and secondly, the unsatisfactory ability of countries in Latin America to properly collect taxes, despite efforts by some countries such as Ecuador and Chile to simplify their tax codes, and this has proven extremely problematic as countries continue to struggle to find ways to increase their revenues through competent institutional frameworks.

Bolivarianism

The final and arguably most controversial method for development that evolved in Latin America at the dawn of the most recent commodity boom is known as the Bolivarian method of social reform, perhaps because it stands between two strong political contradictions; one that suggests that it enlarges to an extent the social participatory framework of the most affected sectors of society most vulnerable during the restructuring neoliberal period of the 1980s and 1990s (thus, creating more political capital for ruling elites), and secondly, it is a strategy that it is arguably “based more on political than economic logic.” (Gaillard, Hira, 176) Among the pillars that this strategy attempts to resurrect, include the nationalization (or re-nationalization in some cases) of private firms, direct control over the financial system, taxes on exports, and some structural state interventions such as ambitious land reform projects. The main proponent of this strategy is Venezuela, as it is named after Venezuelan-born liberator of South America, Simon Bolivar, but it has also been extended to Bolivia, and to a lesser extent, Ecuador, and even more so, Argentina. This strategy is perhaps the one that most commonly reflects some of the features of the structuralist developmental strategy of the previous century (with obvious differences to be considered), by re-establishing the patronage-based relation of the state with industry. Examples of such include the creation of a system of currency exchange controls seen in Argentina and Venezuela (a similar replica to one created in the 1980s known as “RECADI”), which in the case of Venezuela assigns petrodollars generated by the revenues gained by oil exports to the United States, to businesses, industries, and individuals, as well as government contracts with foreign companies, including multinational corporations like Chevron and Exxon Mobile to extract oil in the Orinoco Oil Belt, the world’s largest proven reserves of oil.

Which method of development should Latin American countries pursue?

Ecuador to open up rainforests for oil explorations

This development method has produced positive marks on short-term reductions of critical poverty, as well as sharply reducing the income gap between the richest and poorest sectors of society, though this form of development runs the highest risk of all three development strategies of having its positive marks being drastically reversed once commodity prices collapse, and are consequentially forced into structural neoliberal adjustments, that is, unless they’re able to efficiently restructure their increasingly large internal and external debts as Ecuador and Argentina have begun doing so. To this date, the only commodity of the past decade that has continued to maintain its unprecedented high price is oil; which continues to average out between 90 to 100 dollars per barrel. This might help explain at least partially speaking in strategically political terms, why a country like Ecuador in late 2013 announced it would reverse its policy of recent years of abstaining to extract oil from the highly concentrated region of the Yasuni National Park, much to the disappointment of President Rafael Correa’s electoral indigenous base. Some have suggested that this was done in order to compensate the country’s future loss of revenue from other commodities that have had their price reduced in recent years, though President Correa has cautiously maintained the focus of this controversial decision by insisting on that the initial proposal of rejecting oil exploitation in the area did not gather enough international support.

Commodity Windfalls

Beginning in 2011, it suddenly became inevitable for emerging economies that a decrease in the price of primary commodities had become imminent. The economies of China, India, and others had drastically slowed, and recent policy moves in the United States to normalize its monetary policy, has caused reasons for concern in Latin American markets. Oil and gas excluded, as of March, 2014, prices for commodities are down by a quarter from 2011 levels. The symptoms are being echoed clearly across the region in all countries facing different development strategies. Chile is experiencing its slowest growth in four years, Peru’s average 7% growth since 2005 slowed to 5% in 2013. The same pattern holds true as well for Panama, Mexico, Brazil, Colombia, Uruguay, Venezuela, and others. However, unlike the late 1970s and 1980 when the ISI structuralist era came to an abrupt end, most economies in the region today are now about to face this slowdown in growth with a macroeconomic stable environment, and fortunately, most will not be forced employ drastic spending cuts nor harsh neoliberal reforms.

How Inflation Works (in Spanish)

Two countries in the region stand out as the exceptions to this fortune: Argentina and Venezuela, two countries that ironically have become far too familiar with these financial misfortunes throughout their history. Along with a slowdown in their economies (Venezuela grew at a mere 1.6% in 2013, the lowest in the region), both economies stand out in the region for having the two highest inflation rates in the continent, 56.2% in Venezuela and 28.3% for Argentina in 2013, as well as a troubling growing scarcity of basic products. Evidence suggests that this is not a purely ideological problem, as both Bolivia and Ecuador, two countries with similar development policies, experienced relatively low inflation in the past year. This has more to do with the disproportionally high fiscal spending patterns by both Argentina and Venezuela over the past decade, particularly the latter due to its enormous oil reserves. This structural problem has become exacerbated by the foreign-exchange systems prevalent in both countries that attempt at issuing price controls, and in the case of Venezuela, where production is squashed and nearly everything but petroleum and its refined products is imported, producers have had their access to dollars for imports limited by exchange controls, making scarcity imminent. Perhaps the most evident neoliberal restructuring policy that both of these countries have inevitably been forced to implement has been to allow their currencies to plunge by being devalued greatly, much to the despair of the purchasing power of their populations, just as these two countries once did during the neoliberal reform period during their past debt crisis.

Argentina to Relax Foreign Currency Controls

In response to these woes, Argentine President Cristina Kirchner has of recent emulated the tactics of her late husband and predecessor; “Nestor Kirchner’s anti-IMF stance was heated only in a rhetorical sense, with a compromise outcome occurring following negotiations. Kirchner’s shake-up of the banking and energy contracts was also nationalistic, but, in a sense, a low stakes game, because both sectors were in a freefall following the devaluation of the peso” (Gaillard, Hira, 179), as she has of late secured restructuring loans of up to $3 billion with global financial institutions like the World Bank. Venezuela, on the other hand has attempted to secure similar loans with China by securing long-term agreements of oil shipments to the Asian nation. Included in this new restructuring period for Venezuela, include politically risky moves such as a recent announcement of its government that it would consider raising the price of gasoline for the first time since 1989, a move that many still remember and associate as the catalyst that brought the biggest riots in the country’s history. Some measures have already began, as popular social programs known as ‘misiones’ that provided health care clinics and education to poor communities (considered by many to be one of the most enduring legacies of the late president Chavez) have been shut down and closed, and the price of government-subsidized foods has been hiked as much as three-fold. Devastating outlooks gloom over the oil-rich nation should the price of oil plunge, and thus its most critically important source of revenue, may bring the end of the populist-style of governing that prevailed periodically in Venezuela for many years.

Why is inflation so high in Venezuela?

Finally, no analysis about understanding why Latin American economies boomed (and have now stalled) in the past decade cannot be complete unless it places into context the impact and influence of China, as the main purchaser behind the high demand for Latin American commodities, and as the main investor in the region, which literature suggests, has created another new cycle of dependency in a region infamously known for its repeated cycles of dependency with major global powers. The growingly important relation between China and Latin America can best be exemplified when China upgraded its diplomatic relations with Argentina, Mexico and Venezuela by recognizing them as ‘strategic partners’ in 2000. According to Rhys Jenkins, China has three key interests when it comes to investing on strategic relations with Latin America. First and most importantly, the region serves as an important source of commodities that helps enhance its increasingly growing industrial sector with the energy (primarily from Brazil, Mexico, and Venezuela) and raw materials needed to satisfy the needs of rising income levels in China. Secondly, the region also serves as a key market for manufactured goods that could greatly benefit Chinese exporters. And finally, Latin America has an important role in determining the diplomatic and economic outcome between the People’s Republic of China and Taiwan.

From 2000 to 2010, the amount of exports to Latin America from China has increased seven-fold, and this is most evident when pointing out that by 2009 “China was the top export market for Brazil, Chile and Cuba and the second most important for Colombia, Costa Rica and Peru.” (Jenkins, 1339) One of the ways that China has expanded its share of trade and economic influence in the region is through the use of Foreign Direct Investment (FDI) in Latin American industries, 90% of which from 2002 to 2007 were made up of government-sponsored investments. Two-thirds of such investments consisted primarily of natural resources, “while 28% were in infrastructure and public works, part of which may also have been related to gaining access to raw materials.” (Jenkins, 1345) “Some of the most high-profile examples include loans of $10 billion from the China Development Bank to Petrobras in Brazil in 2009 in return for 200,000 barrels of oil a day and to the Venezuelan government in 2010 for between 200,000 and 300,000 barrels a day.” (Jenkins, 1345) When taking into account that China’s sharp increase in its net trade deficit since the late 1990s of primary commodities from Latin America’s exports such as soybeans, iron, copper, and ore, one might conclude that “since this pattern holds for all the major Latin American countries exporting to China, it would seem that the explanation must be sought in events in China rather than in developments in the various Latin American countries.” (Jenkins, 1338) Another way to understand this asymmetrical relationship is by acknowledging how has the diplomatic recognition of Taiwan by some Latin American countries affected their export outcomes, as China continues to pursue its “One China Policy’ which holds that it will not recognize countries with diplomatic relations with Taiwan. To put this this into context, “since 2004 Taiwan has signed free trade agreements with five Central American countries: Panama, Guatemala, Nicaragua, El Salvador and Honduras. Costa Rica, on the other hand, signed a free trade agreement with the PRC in 2010.” (Jenkins, 1347) “The issue of diplomatic recognition has a significant influence on trade, foreign direct investment and aid and other financial flows to the region” (Jenkins, 1347) and this has become considerably essential when noting that it has been primarily these Central American countries and Paraguay which still recognize Taiwan diplomatically, that did not experience a strong commodity boom over the past decade. Paraguay, for example, in 2010 became the country in the region with the largest share of total imports of Chinese goods. This is yet another symptom that the relationship of China with the region is purely asymmetrical, and “it has given rise to concerns that Latin America is returning to a dependence on primary commodities and that its manufacturing industries are being increasingly displaced by competition from Chinese imports.” (Jenkins, 1355) It seems China has begun to replace the West as the major global power from which Latin America has grown dependent on its population’s growing consumption patterns, and this begs the question whether this strategy for growth is sustainable in the long run for a region that has overall concentrated its development on export concentration of primary commodity products, as it once was prior to the ISI period.

With difficult years ahead, Latin America nevertheless has an overall positive outlook in the coming years, as it appears that even with a fall in the prices of commodities; most countries appear to have restructured their finances efficiently to prevent some externalities of commodity windfalls. On the other hand, the dependence on China as its main investor in the region has caused growing concern on whether a purely export-led growth of basic primary commodities is sustainable in the long run for the development and long-term growth of its industrial and manufacturing sectors. As Latin America integrates itself progressively into the world economy, it will surely be fascinating to witness how the region evolves in all of its different new strategies for development, and if populism will acquire once and for all a more responsible macroeconomic edge towards its relationship with society, as it has for most countries in the region.

Bibliography/Sources:

Arezki, Rabah, and Markus Brückner. "Commodity Windfalls, Democracy, and External Debt*." The Economic Journal (2012): 848-66. Print.

Arezki, Rabah, and Markus Brückner. "Commodity Windfalls, Democracy, and External Debt*." The Economic Journal (2012): No. Print.

Blanco, Luisa, and Robin Grier. "Explaining the Rise of the Left in Latin America." Latin American Research Review 48.1 (2013): 68-90. Print.

Brown, Jonathan C. "From Structuralism to the New Institutional Economics: A Half Century of Latin American Economic Historiography." Latin American Research Review 40.3 (2005): 97-99. JSTOR. Web. 26 Mar. 2014. <http://www.jstor.org/stable/3662823>.

Caldentey, Esteban Pérez, and Matías Vernengo. "Back to the Future: Latin America's Current Development Strategy." Journal of Post Keynesian Economics 32.4 (2010): 623-44. Print.

"A Fistful of Dollars, or Perhaps Not." The Economist. The Economist Newspaper, 01 Apr. 2014. Web. 8 Apr. 2014. <http://www.economist.com/blogs/americasview/2014/04/venezuelas-byzantine-exchange-rate-system>.

"Flexible Friends." The Economist. The Economist Newspaper, 12 Apr. 2014. Web. 14 Apr. 2014. <http://www.economist.com/news/americas/21600686-china-lends-disproportionately-countries-lack-other-options-flexible-friends>.

Hira, Anil, and Norbert Gaillard. "The Bottom Line: The Fundamental Weaknesses of Latin American Finance." Bulletin of Latin American Research 30.2 (2011): 163-82. Print.

Jenkins, Rhys. "Latin America and China—a New Dependency?" Third World Quarterly 33.7 (2012): 1337-358. Print.

Leitner, Sandra M., and Robert Stehrer. "Access to Finance and Funding Composition during the Crisis: A Firm-level Analysis of Latin American Countries." Latin American Journal of Economics 50.1 (2013): 1-47. JSTOR. Web. 12 Mar. 2014. <http://www.jstor.org/discover/10.2307/41959249?uid=37531&uid=3739600&uid=2134&uid=2&uid=70&uid=3&uid=37526&uid=67&uid=62&uid=3739256&sid=21103667259841>.

"Life after the Commodity Boom." The Economist. The Economist Newspaper, 29 Mar. 2014. Web. 25 Mar. 2014. <http://www.economist.com/news/americas/21599782-instead-crises-past-mediocre-growth-big-riskunless-productivity-rises-life>.

Medeiros, Carlos Aguiar De. "The Political Economy of Institutional Change and Economic Development in Latin American Economies." Journal of Economic Issues 0.2 (2011): 289-300. Print.

Neuman, William. "Venezuela May Meet New Reality, and New Price, at the Pump." The New York Times. The New York Times, 20 Jan. 2014. Web. 8 Apr. 2014. <http://www.nytimes.com/2014/01/21/world/americas/venezuela-gasoline-prices.html>.

Romero, Simon, and Jonathan Gilbert. "The Influential Minister Behind Argentina’s Economic Shift." The New York Times. The New York Times, 26 Jan. 2014. Web. 5 Apr. 2014. <http://www.nytimes.com/2014/01/27/world/americas/the-influential-minister-behind-argentinas-economic-shift.html?action=click&contentCollection=Americas&module=RelatedCoverage®ion=Marginalia&pgtype=article>.

Österholm, Pär. "The Effect of External Conditions on Growth in Latin America." IMF Staff Papers 55.4 (2008): 595-623. JSTOR. Web. 25 Mar. 2014. <http://www.jstor.org/stable/10.2307/40377792?ref=search-gateway:6886b298bfa48acce56fad88fb476a6e>.

Swan, Philip L. "Economic Reform in Latin America." Business Economics 27.2 (1992): 18-23. JSTOR. Web. 25 Mar. 2014. <http://www.jstor.org/stable/10.2307/23485863?ref=search-gateway:2ab43131b3a7dfd5dbb3fb66bbd95475>.

Vera, Leonardo. "Some Useful Concepts for Development Economics in the Tradition of Latin American Structuralism." American Journal of Economics and Sociology 72.4 (2013): 917-48. JSTOR. Web. 4 Mar. 2014. <http://www.jstor.org/stable/10.2307/23526067?ref=search-gateway:a7506f8ea8367a06880725aafe60bebb>.